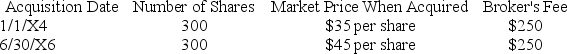

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase). (Do not round intermediate calculations.)

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Assume thatJoe (single)has a marginal tax rate

Q44: Investment interest expense does not include:

A)interest expense

Q51: Unused investment interest expense:

A)expires after the current

Q52: Compare and contrast how interest income is

Q55: Which taxpayer would not be considered a

Q59: Alain Mire files a single tax return

Q67: Mr. and Mrs. Smith purchased 100 shares

Q71: How are individual taxpayers' investment expenses and

Q72: What are the rules limiting the amount

Q82: The Crane family recognized the following types

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents