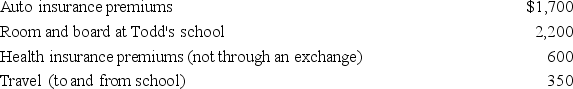

Ned is a head of household with a dependent son, Todd, who is a full-time student. This year Ned made the following expenditures related to Todd's support:  What amount can Ned include in his itemized deductions?

What amount can Ned include in his itemized deductions?

A) $1,700 included in Ned's miscellaneous itemized deductions.

B) $2,050 included in Ned's miscellaneous itemized deductions.

C) $950 included in Ned's miscellaneous itemized deductions.

D) $600 included in Ned's medical expenses.

E) None of the choices are correct.

Correct Answer:

Verified

Q43: This fall Millie finally repaid her student

Q45: Hector is a married, self-employed taxpayer, and

Q47: Max, a single taxpayer, has a $270,000

Q48: Bruce is employed as an executive and

Q52: This year Riley files single and reports

Q54: Which of the following costs are deductible

Q58: Han is a self-employed carpenter and his

Q58: Brice is a single,self-employed electrician who earns

Q61: Kaylee is a self-employed investment counselor who

Q78: Larry recorded the following donations this year:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents