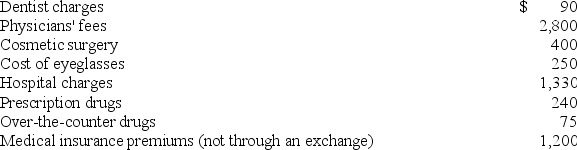

Jenna (age 50)files single and reports AGI of $40,000. This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Correct Answer:

Verified

All expenses are qualified medic...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Campbell, a single taxpayer, has $400,000 of

Q56: Campbell, a single taxpayer, has $400,000 of

Q61: Which of the following is a true

Q62: Glenn is an accountant who races stock

Q66: Andres and Lakeisha are married and file

Q71: Alexandra operates a garage as a sole

Q74: Which of the following is a true

Q76: Detmer is a successful doctor who earned

Q80: Chuck has AGI of $70,000 and has

Q86: Tita, a married taxpayer filing jointly, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents