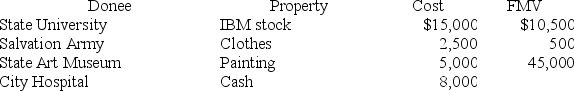

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Campbell, a single taxpayer, has $400,000 of

Q56: Campbell, a single taxpayer, has $400,000 of

Q74: Which of the following is a true

Q76: Detmer is a successful doctor who earned

Q80: Chuck has AGI of $70,000 and has

Q82: This year Latrell made the following charitable

Q86: Rachel is an engineer who practices as

Q93: Rachel is an accountant who practices as

Q94: Rachel is an accountant who practices as

Q111: This year Kelly bought a new auto

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents