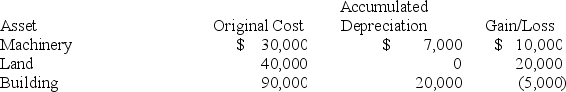

Brandon, an individual, began business four years ago and has sold §1231 assets with $5,000 of losses within the last five years. Brandon owned each of the assets for several years. In the current year, Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Use dividends and capital gains tax rates for reference.

A) $25,000 ordinary income and $8,000 tax liability.

B) $25,000 §1231 gain and $3,750 tax liability.

C) $13,000 §1231 gain, $12,000 ordinary income, and $5,790 tax liability.

D) $12,000 §1231 gain, $13,000 ordinary income, and $5,960 tax liability.

E) None of the choices are correct.

Correct Answer:

Verified

Q24: Leesburg sold a machine for $2,200 on

Q50: Sumner sold equipment that it uses in

Q63: Why does §1250 recapture generally no longer

Q66: Which one of the following is not

Q73: Which one of the following is not

Q81: A deferred like-kind exchange does not help

Q84: How long after the initial exchange does

Q89: The general rule regarding the exchanged basis

Q94: Each of the following is true except

Q100: Arlington LLC exchanged land used in its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents