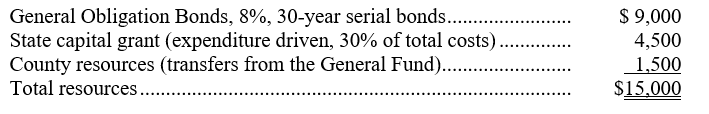

Moore County is developing a new all-sports county park. The estimated cost of the project is $15,000 (all amounts are in thousands of dollars). Funding is being provided for the project based on the following schedule:

1. The bonds were issued at 104 and with $20 in bond issue costs.

2. The funding from the General Fund was received.

3. The county purchased land for the project paying $2,000 in cash.

4. A contract for construction of the required facilities 12,000.

5. During the year, the county was billed $8,000 for the project. It was projected that this billing is for 75% of the construction project. The county paid all but 10% of the amount. The balance will be paid when the contract is completed.

6. Near the end of the fiscal year, the state paid the amount owed, less 20% that is in question. This amount will be paid no earlier than 90 days into the following fiscal year.

1. Prepare all the entries required in the Park Capital Projects Fund for Moore County for these transactions and events. No explanations are required. If not entry is required, state "No entry required" and state why. All amounts are in thousands of dollars.

2. Indicate the effects of each transaction on the accounting equation of the Capital Projects Fund and on the General Capital Assets and General Long-Term Liabilities accounts. If an element is not affected, put "NE" in the appropriate box.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: A government had $7,000,000 of 5%, six-month

Q10: The City of Bamberg, which has a

Q11: A government issued bond anticipation notes to

Q12: Which of the following statements is true

Q13: A government issued short-term bond anticipation notes

Q15: Which of the following is a

Q16: A county government secured a six-month, $600,000

Q17: If a governmental entity issued a six-month,

Q18: Which of the following transactions would not

Q19: Retirement of the principal of a bond

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents