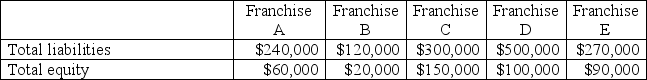

Using the debt to equity ratio, which of the following franchises would be assessed as having the riskiest financing structure?

A) Franchise A

B) Franchise B

C) Franchise C

D) Franchise D

E) Franchise E

Correct Answer:

Verified

Q43: Bonds owned by investors whose names and

Q45: Operating leases differ from capital leases in

Q47: What is the debt to equity ratio

Q48: Bonds that mature at different dates and

Q49: Secured bonds:

A)Are also referred to as debentures.

B)Have

Q51: Sinking fund bonds:

A)Require the issuer to set

Q52: A bond traded at 102½ means that:

A)

Q54: If an issuer sells a bond at

Q65: Adidas issued 10-year,8% bonds with a par

Q85: A bond sells at a discount when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents