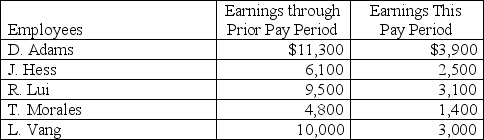

A company's employees had the following earnings records at the close of the current payroll period:

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $87,000 plus 1.45% FICA Medicare on all wages; 0.8% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000. Compute the employer's total payroll taxes expense for the current pay period.

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $87,000 plus 1.45% FICA Medicare on all wages; 0.8% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000. Compute the employer's total payroll taxes expense for the current pay period.

Correct Answer:

Verified

Q140: A company sells its product subject to

Q141: An employee earned $3,450 wages for the

Q145: A company borrowed $60,000 on a 60-day,10%

Q150: Home Depot had income before interest expense

Q158: On November 1,2012,Bob's Skateboards Store signed a

Q159: A company's payroll information for the

Q160: Metro Express has five sales employees,each of

Q165: A company sells computers with a six-month

Q171: _ are probable future payments of assets

Q200: _ are amounts owed to suppliers for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents