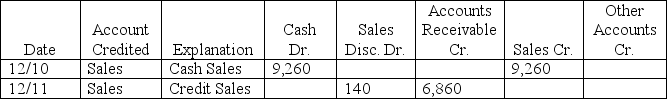

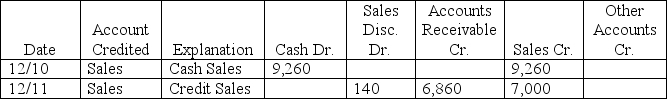

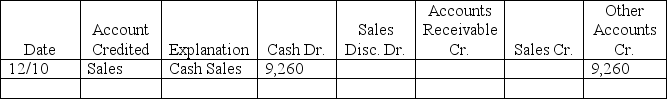

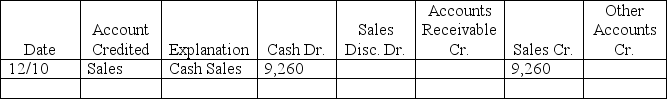

Argyle Company uses a cash receipts journal (periodic system) as shown below: How would the following transactions be recorded in this cash receipt journal?

-12/10 Sold merchandise to Sock Company for $9,260 cash (cost is $5,556)

- 12/11 Sold merchandise on credit to Gardner, Inc, invoice no. 873, for $7,000 (cost is $4,200) . Terms are 2/10, n/30.

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q87: A company borrowed money from the bank

Q88: In a typical cash disbursements journal,you would

Q90: Enterprise-resource planning software:

A) Refers to programs that

Q92: When the sales journal's column for accounts

Q95: A business segment:

A) Requires only internal reporting.

B)

Q96: The main difference in the sales journal

Q104: A company uses a cash receipts journal

Q105: Identify the accounting information system principle below

Q115: What are the five basic components of

Q139: What is the segment return on assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents