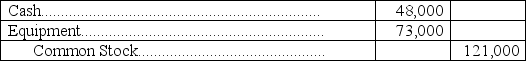

S. Reising contributed $48,000 in cash plus equipment valued at $73,000 to the Reising Construction Partnership. The journal entry to record the transaction for the partnership is:

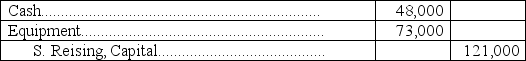

A)

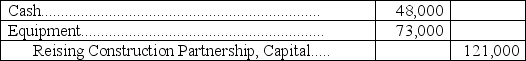

B)

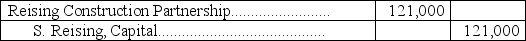

C)

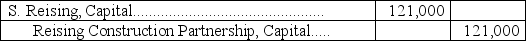

D)

E)

Correct Answer:

Verified

Q27: Admitting a partner into a partnership by

Q42: Rice,Hepburn and DiMarco formed a partnership with

Q42: The withdrawals account of each partner is:

A)

Q44: Elaine Valero is a limited partner in

Q49: In the absence of a partnership agreement,

Q49: Chad Forrester is a limited partner in

Q50: Blaser,Lukins,and Franko formed a partnership with Blaser

Q52: Collins and Farina are forming a partnership.

Q53: Partners' withdrawals of assets are:

A) Credited to

Q60: Chen and Wright are forming a partnership.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents