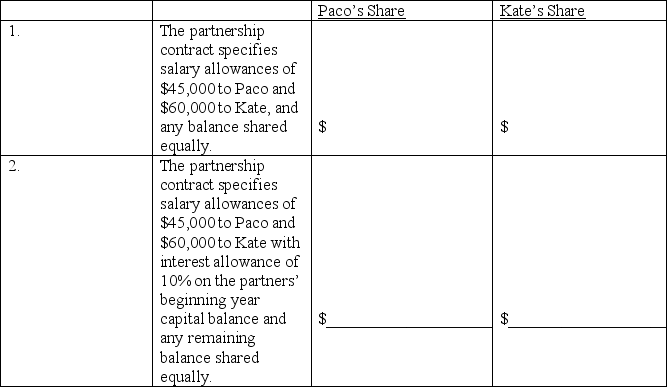

Paco and Kate invested $99,000 and $126,000, respectively, in a partnership they began one year ago. Assuming the partnership earned $120,000 during the current year, compute the share of the net income each partner should receive under each of these independent assumptions.

Correct Answer:

Verified

Q102: Khalid,Dina,and James are partners with beginning-year capital

Q104: Holden,Phillips,and Rogers are partners with beginning-year capital

Q108: Armstrong plans to leave the FAP Partnership.The

Q110: Durango and Verde formed a partnership with

Q114: Alberts and Bartel are partners.On October 1,Alberts'

Q118: Armstrong withdraws from the FAP Partnership. The

Q120: Baldwin and Tanner formed a partnership.Baldwin's initial

Q128: _ implies that each partner in a

Q133: What are the ways a partner can

Q163: During the closing process, each partner's withdrawals

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents