On November 12, Kera, Inc., a U.S. company, sold merchandise on credit to Kakura Company of Japan at a price of 1,500,000 yen. The exchange rate was $0.00837 on the date of sale. On December 31, when Kera prepared its financial statements, the exchange rate was $0.00843. Kakura Company paid in full on January 12, when the exchange rate was $0.00861. On January 12, Kera should prepare the following journal entry for this transaction:

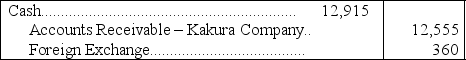

A)

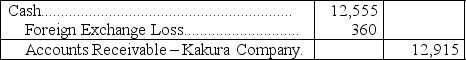

B)

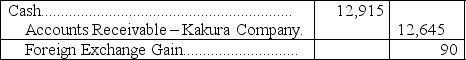

C)

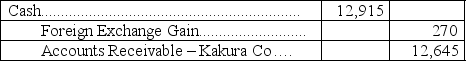

D)

E)

Correct Answer:

Verified

Q98: A company has net income of $250,000,net

Q104: On January 1, 2011, Posten Company purchased

Q107: A U.S. company makes a sale to

Q108: Vans purchased 40,000 shares of Skechers common

Q108: On January 4, 2011, Larsen Company purchased

Q110: Chung owns 40% of Lu's common stock.

Q110: On November 12, Kendra, Inc., a U.S.

Q111: If a company owns more than 20%

Q125: Explain the difference between short-term and long-term

Q159: What are the accounting basics for debt

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents