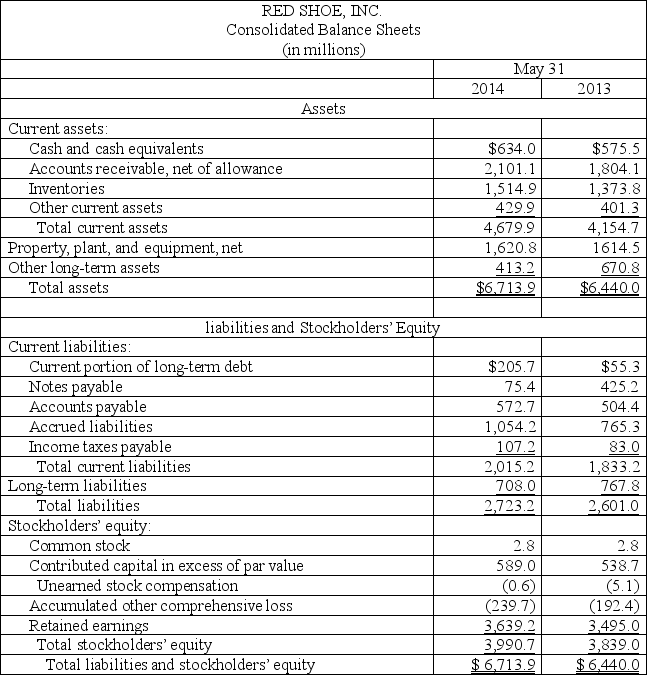

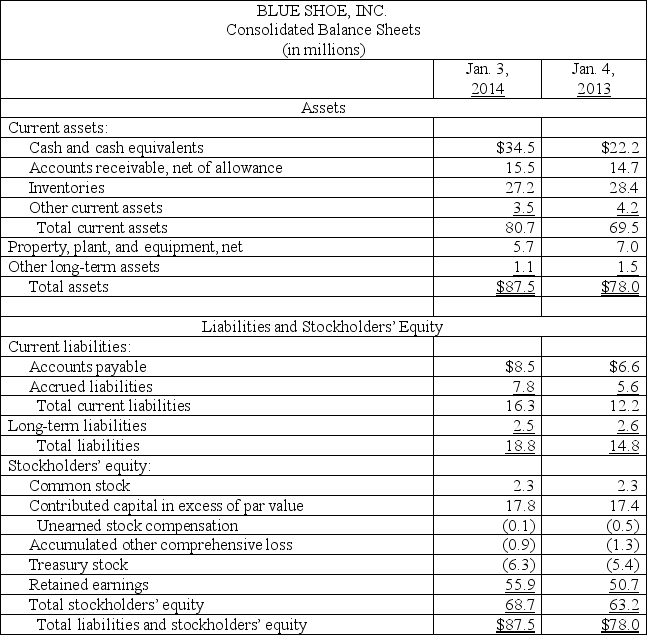

The following are summaries from the income statements and balance sheets of Red Shoe, Inc. and Blue Shoe, Inc.

RED SHOE, ПNC.

RED SHOE, ПNC.

Consolidated Statement of Income

May 31, 2014

(in millions)

BLUE SHOE, INC

BLUE SHOE, INC

Consolidated Statement of Income

January 3, 2014

(in millions)

(1) For both companies compute the following ratios for 2014:

(a) Current ratio

(b) Acid-test ratio

(c) Accounts receivable turnover

(d) Inventory turnover

(e) Days' sales in inventory

(f) Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2) For both companies compute the following ratios for 2014:

(a) Profit margin ratio

(b) Return on total assets

(c) Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Correct Answer:

Verified

Q149: Comparative calendar-year financial data for a

Q150: The following information is from Omega

Q151: A company's calendar-year financial data are shown

Q152: Comparative calendar year financial data for

Q153: Selected balances from a company's financial

Q155: Given the following information about a corporation's

Q158: Information from a manufacturing company's current

Q202: A company reported net income of $78,000

Q208: A company paid cash dividends on its

Q224: The measurement of key relationships between financial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents