An investor has $450,000 to invest in two types of investments.Type A pays 6% annually and type B pays 7% annually.To have a well-balanced portfolio, the investor imposes the following conditions.At least one-third of the total portfolio is to be allocated to type A investments and at least one-third of the portfolio is to be allocated to type B investments.What is the optimal amount that should be invested in each investment?

A) $160,000 in type A (6%) , $290,000 in type B (7%)

B) $0 in type A (6%) , $450,000 in type B (7%)

C) $450,000 in type A (6%) , $0 in type B (7%)

D) $300,000 in type A (6%) , $150,000 in type B (7%)

E) $150,000 in type A (6%) , $300,000 in type B (7%)

Correct Answer:

Verified

Q41: An animal shelter mixes two brands of

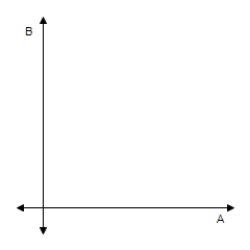

Q44: Select the correct graph of the

Q45: An accounting firm has 780 hours of

Q45: Select the correct graph of the

Q46: A merchant plans to sell two models

Q46: Select the correct graph of the

Q50: Find the maximum value of the

Q51: Select the correct graph of the

Q53: Select the correct graph of the

Q54: Find the minimum and maximum values

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents