-Jeter Company ordered 400 toy wagons from Lamar, Inc. on May 1, 2018. Jeter Company paid for them on May 20 at a cost of $3 each. Jeter sold 50 of them on June 2, 2018, for $4 each to Gilloz Company. Gilloz Company paid Jeter on June 10.

On which date should Jeter Company recognize revenue?

A) May 1

B) May 20

C) June 10

D) June 2

Correct Answer:

Verified

Q75: Joseph Corporation purchased an extruding machine on

Q76: During January of 2018, Barry Corporation purchased

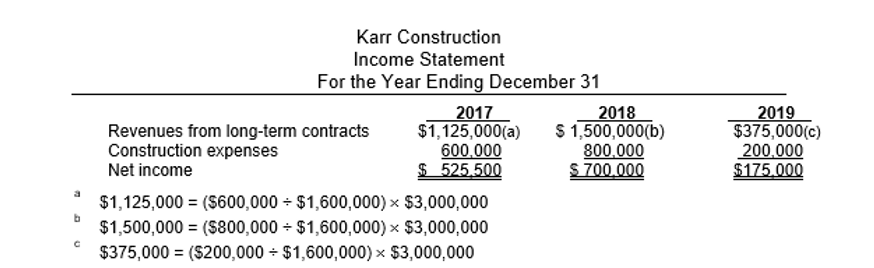

Q77: Karr Construction built a levee for

Q78: On March 1, 2018, $72,000 of annual

Q79: During 2003, Jeter Company purchased property for

Q81: Why are market values not used for

Q82: When is present value be used on

Q83: On January 27, 2018, Lock Company entered

Q84: Short-term investments have an original cost of

Q85: Why is materiality a major problem in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents