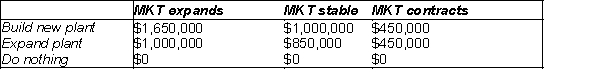

The Waco Tire Company (WTC) is considering expanding production to meet possible increases in demand. WTC's alternatives are to construct a new plant, expand the existing plant, or do nothing in the short run. It will cost them $1 million to build a new facility and $600,000 to expand their existing facility. The market for this particular product may expand, remain stable, or contract. ETC's marketing department estimates the probabilities of these market outcomes as 0.30, 0.45, and 0.25, respectively. The expected revenue for each alternative is presented in the table below.

-(A) What is WTC's payoff if they build a new plant and the market expands?

(B) What is WTC's payoff if they build a new plant and the market is stable?

(C) What is WTC's payoff if they build a new plant and the market contracts?

(D) What is WTC's payoff if they expand the plant and the market expands?

(E) What is WTC's payoff if they expand the plant and the market is stable?

(F) What is WTC's payoff if they expand the plant and the market contracts?

(G) What is WTC's payoff if they do nothing and the market expands?

(H) What is WTC's payoff if they do nothing and the market is stable?

(I) What is WTC's payoff if they do nothing and the market contracts?

Correct Answer:

Verified

(B) $0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: A risk profile lists the full probability

Q21: A buyer for a large sporting goods

Q23: A risk profile from PrecisionTree lists:

A) the

Q24: Tyson Manufacturing (a maker of industrial products)

Q25: (A) Construct a decision tree to help

Q27: What should the credit union do? What

Q28: What course of action is optimal for

Q41: Construct a decision tree to identify the

Q55: Generate a risk profile for each of

Q79: Construct a decision tree to help the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents