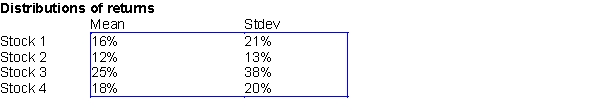

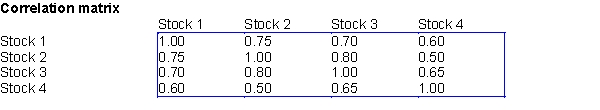

Suppose that Ms. Smart invests 25% of her portfolio in four different stocks. The mean and standard deviation of the annual return on each stock are shown in the first table below. The correlations between the annual returns on the four stocks are shown in the second table below.

-(A) Use @RISK with 100 replications, provide a summary statistics of portfolio return; namely, minimum, maximum, mean, and standard deviation.

(B) Use your answers to (A) to estimate the probability that Mrs. Smart's portfolio's annual return will exceed 20%.

(C) Use your answers to (A) to estimate the probability that Mrs. Smart's portfolio will lose money during the course of a year.

(D) Suppose that the current price of each stock is as follows: stock 1: $16; stock 2: $18; stock 3: $20; and stock 4: $22. Ms. Smart has just bought an option involving these four stocks. If the price of stock 1, six months from now are is $18 or more, the option enables Ms. Smart to buy, if she desires, one share of each stock for $20 six months from now. Otherwise the option is worthless. For example, if the stock prices six months from now are: stock 1: $18; stock 2: $20; stock 3: $21; and stock 4: $24, then Ms. Smart would exercise her option to buy stocks 3 and 4 and receive (21- 20) + (24-20) = $5 in each cash flow. How much is this option worth if the risk-free rate is 8%?

Correct Answer:

Verified

Selected summary statistics of portf...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: A correlation matrix must always be symmetric,so

Q25: RISKSIMTABLE is a function in @RISK for

Q26: It is usually not too difficult to

Q27: When we maximize or minimize the value

Q37: It is common in computer simulations to

Q43: Which of the following statements are true?

A)The

Q59: It is simple to generate a uniformly

Q63: Oregon State University has reached the final

Q65: Oregon State University has reached the final

Q67: Oregon State University has reached the final

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents