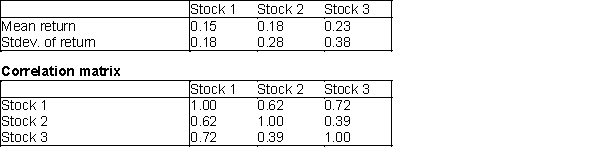

Assume that you are given the following means, standard deviations, and correlations for the annual return on three stocks.  The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39. You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39. You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

Correct Answer:

Verified

Q36: Any integer programming problem involving 0-1 variables

Q69: You are given the following means,standard deviations,and

Q76: A manufacturer can sell product 1 at

Q85: Discuss how the company's optimal production schedule

Q87: Laila, an Egyptian broker, is currently trying

Q90: Which of the following is not an

Q91: At time 0, you have $10,000. Investments

Q92: A knapsack problem is any integer program

Q93: A total of 160 hours of labor

Q94: Suppose that on Monday morning you have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents