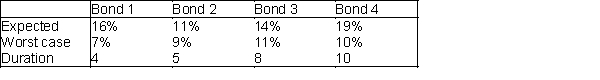

A company is considering investing a total amount of $2.50 million in four bonds. The expected annual return, the worst-case annual return on each bond, and the "duration" of each bond are given in the table below.  The duration of a bond is a measure of the bond's sensitively to interest rates. The company wants to maximize the expected return from its bond investments, subject to the following constraints:

The duration of a bond is a measure of the bond's sensitively to interest rates. The company wants to maximize the expected return from its bond investments, subject to the following constraints:

∙ The worst-case return of the bond portfolio must be at least 90%.

∙ The average duration of the portfolio must be at most 7.

∙ Because of diversification requirements, at most 35% of the total amount invested in a single bond.

Determine how the company can maximize the expected return on its investment.

Correct Answer:

Verified

Q21: A global optimal solution is not necessarily

Q32: For some types of integer programming problems,their

Q64: A minimum cost network flow model (MCNFM)has

Q75: In nonlinear models,which of the following statements

Q80: Determine how to minimize the company's total

Q100: Discuss how the company's optimal production schedule

Q101: A pharmaceutical company produces a drug from

Q102: An oil company produces oil at two

Q106: A company manufactures two products. If it

Q109: Your parents are discussing their retirement portfolio

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents