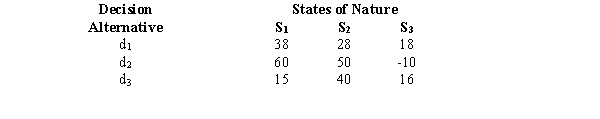

Suppose we are interested in investing in one of three investment opportunities: d1, d2, or d3. The following profit payoff table shows the profits (in thousands of dollars) under each of the 3 possible economic conditions-S1, S2, and S3.  Assume the states of nature have the following probabilities of occurrence.P(S1) = 0.2

Assume the states of nature have the following probabilities of occurrence.P(S1) = 0.2

P(S2) = 0.3

P(S3) = 0.5

a.Determine the expected value of each alternative and indicate which decision alternative is the best.

b.Determine the expected value with perfect information about the states of nature.

c.Determine the expected value of perfect information.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Assume you are faced with the following

Q42: Exhibit 21-5

Below you are given a payoff

Q43: Suppose we are interested in investing in

Q44: The following payoff table shows profits for

Q45: The owner of a new gourmet kitchenware

Q47: Assume you are faced with the following

Q48: You are given the following payoff

Q49: Exhibit 21-5

Below you are given a payoff

Q50: Michael, Nancy, & Associates (MNA) produce color

Q51: Exhibit 21-5

Below you are given a payoff

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents