On January 1, 2016 Grier Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2017 more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Grier Company uses the straight-line method of depreciation.

Instructions

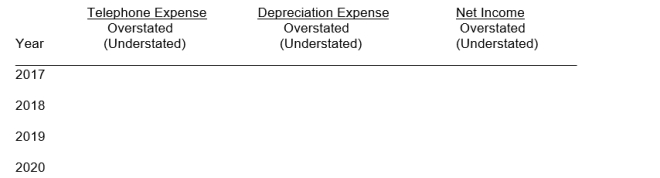

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2017 through the useful life of the new equipment.

Correct Answer:

Verified

Q241: Karley Company sold equipment on July 1,

Q242: A plant asset acquired on October 1,

Q243: Equipment was acquired on January 1, 2015,

Q244: The December 31, 2017 balance sheet of

Q245: South Airlines purchased a 747 aircraft on

Q247: Jack's, a popular pizza hang-out, has a

Q248: Brown Company purchased equipment in 2011 for

Q249: Dougan Company purchased equipment on January 1,

Q250: Zimmer Company sold the following two machines

Q258: Identify the following expenditures as capital expenditures

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents