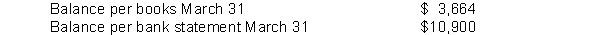

Bell Food Store developed the following information in recording its bank statement for the month of March.  -------------------------------------------

-------------------------------------------

(1) Checks written in March but still outstanding $7,000.

(2) Checks written in February but still outstanding $3,100.

(3) Deposits of March 30 and 31 not yet recorded by bank $5,200.

(4) NSF check of customer returned by bank $1,200.

(5) Check No. 210 for $593 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $539.

(6) Bank service charge for March was $50.

(7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March.

(8) The bank collected a note receivable for the company for $3,000 plus $100 interest revenue.

Instructions

Prepare a bank reconciliation at March 31.

Correct Answer:

Verified

Q188: Ernest Company uses an imprest petty cash

Q189: The following adjusting entries for Donkey Company

Q190: The cash records of Mercury Company show

Q193: Indicate how each of the following items

Q193: On October 1, 2018, Ellington Company

Q194: The petty cash fund of $200 for

Q195: The cash records of Jasmin Company show

Q195: Using the code letters below, indicate how

Q196: The cash balance per books for Feagen

Q208: In preparing a bank reconciliation outstanding checks

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents