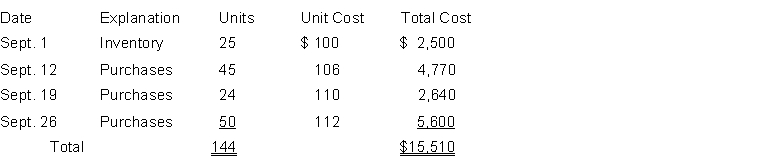

Stengel Company sells a snowboard, White-Out, that is popular with snowboard enthusiasts. Presented below is information relating to Stengel Company's purchases of White-Out snowboards during September. During the same month, 124 White-Out snowboards were sold at $160 each. Stengel Company uses a periodic inventory system.  Instructions

Instructions

(a) Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO method. Prove the amount allocated to cost of goods sold under each method.

(b) For both FIFO and LIFO, calculate the sum of inventory and cost of goods sold. What do you notice about the answer you found for each method?

(c) What is gross profit under each method?

(d) Which method results in a larger amount reported for assets on the balance sheet? Which results in a larger amount reported for stockholders' equity on the balance sheet?

Correct Answer:

Verified

FIFO $2240 (ending inventory) + 1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q204: The _ method tracks the actual physical

Q226: Two widely used methods of estimating inventories

Q226: Errors occasionally occur when physically counting inventory

Q227: Naughty Dog Disc Golf Show uses the

Q228: The lower-of-cost-or-net realizable value basis of accounting

Q228: FIFO and LIFO are the two most

Q229: Robert Tingle is studying for the next

Q230: In a period of rising prices, the

Q231: _ is calculated as cost of goods

Q235: Match the items below by entering the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents