Buena Vista Social Club accumulates the following adjustment data at December 31.

1. Revenue of $1,600 collected in advance has been recognized.

2. Salaries of $600 are unpaid.

3. Prepaid rent totaling $500 has expired.

4. Supplies of $450 have been used.

5. Revenue recognized but unbilled total $750.

6. Utility expenses of $250 are unpaid.

7. Interest of $300 has accrued on a note payable.

Instructions

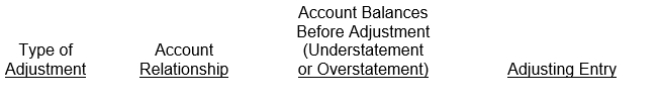

(a) For each of the above items indicate:

1. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

2. The account relationship (asset/liability, liability/revenue, etc.).

3. The status of account balances before adjustment (understatement or overstatement).

4. The adjusting entry.

(b) Assume net income before the adjustments listed above was $15,500. What is the adjusted net income?

Prepare your answer in the tabular form presented below.

Correct Answer:

Verified

Q183: Under IFRS income is defined as

A) revenue

Q190: The time period assumption is used under

A)

Q197: Revenue recognition fraud is

A) a major issue

Q199: Revenue recognition under IFRS is

A) substantially different

Q200: Pavement Company purchased a truck from Bee

Q202: The adjusted trial balance of Hanson Hawk

Q203: Hal Corp. prepared the following income statement

Q204: The adjusted trial balance of Sodajerk Company

Q205: The adjusted trial balance of the Victoria

Q206: Before month-end adjustments are made, the February

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents