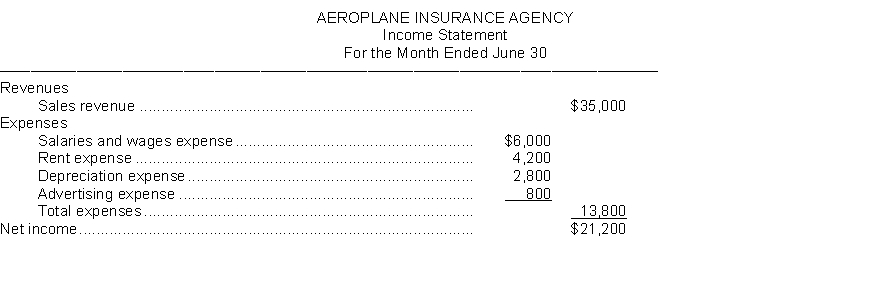

Aeroplane Insurance Agency prepares monthly financial statements. Presented below is an income statement for the month of June that is correct on the basis of information considered.  Additional Data: When the income statement was prepared, the company accountant neglected to take into consideration the following information:

Additional Data: When the income statement was prepared, the company accountant neglected to take into consideration the following information:

1. A utility bill for $2,500 was received on the last day of the month for electric and gas service for the month of June.

2. A company insurance salesman sold a life insurance policy to a client for a premium of $25,000. The agency billed the client for the policy and is entitled to a commission of 20%.

3. Supplies on hand at the beginning of the month were $3,000. The agency purchased additional supplies during the month for $4,000 in cash and $2,200 of supplies were on hand at June 30.

4. The agency purchased a new car at the beginning of the month for $22,000 cash. The car will depreciate $5,400 per year.

5. Salaries owed to employees at the end of the month total $6,100. The salaries will be paid on July 5.

Instructions

Prepare a correct income statement.

Correct Answer:

Verified

Q222: Mother Hips Garment Company purchased equipment on

Q229: Presented below is the Trial Balance and

Q230: Compute the net income for 2018

Q233: Scotsman Company prepares monthly financial statements. Below

Q233: For each of the following accounts indicate

Q235: Prepare the required end-of-period adjusting entries for

Q236: The following ledger accounts are used by

Q237: The Shins, a minor league baseball team,

Q238: Prepare the necessary adjusting entry for each

Q239: The adjusted trial balance of C.S. Financial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents