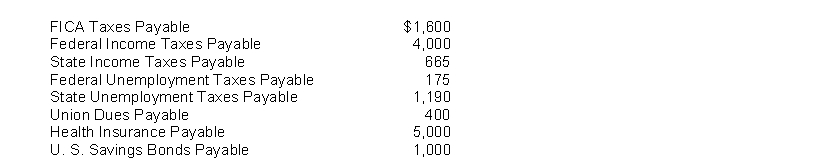

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2018:  In January, the following transactions occurred:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Correct Answer:

Verified

Q22: Which of the following is not performed

Q23: Control over timekeeping does not include

A) having

Q25: An employee's payroll check is distributed by

Q28: Ann Hech's regular hourly wage is $18

Q29: Sam Geller had earned (accumulated) salary of

Q106: Which of the following employees would likely

Q154: The tax that is paid equally by

Q208: Two federal taxes which are levied against

Q215: The employer incurs a payroll tax expense

Q217: A payroll tax expense which is borne

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents