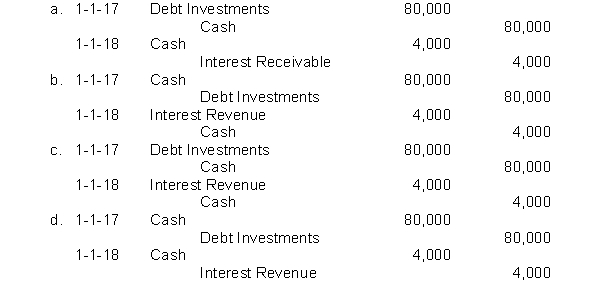

Porter Brothers Company purchased a debt investment for $80,000 on January 1, 2017. On January 1, 2018, Porter received cash interest of $4,000. Which of the following correctly presents the journal entries for the purchase and the receipt of interest?

Correct Answer:

Verified

Q69: McComb Inc. earns $1,350,000 and pays cash

Q70: On January 1, U.K. Enterprise purchased as

Q71: Charleston Co. purchased 60, 6% APS Company

Q72: Which of the following is a true

Q73: On January 1, Vega Company purchased as

Q75: On January 1, Waverly Company purchased as

Q76: On January 1, Bay View Company purchased

Q77: If a debt investment is sold, the

Q78: All of the following factors would be

Q79: On August 1, Basil Company buys 2,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents