On January 5, 2017, JBC Company purchased the following stock investments:

300 shares Getz Corporation common stock for $4,800.

500 shares Keller Corporation common stock for $10,000.

600 shares R-tel Corporation common stock for $18,000.

Assume that JBC Company cannot exercise significant influence over the activities of the investee companies and that the cost method is used to account for the investments.

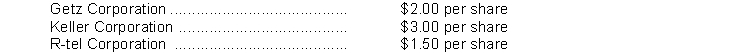

On June 30, 2017, JBC Company received the following cash dividends:  On November 15, 2017, JBC Company sold 100 shares of R-tel Corporation common stock for $3,600.

On November 15, 2017, JBC Company sold 100 shares of R-tel Corporation common stock for $3,600.

On December 31, 2017, the fair value of the securities held by JBC Company is as follows: Instructions

Prepare the appropriate journal entries that the JBC Company should make on the following dates: January 5,2017

June 30,2017

November 15, 2017

December 31,2017

Correct Answer:

Verified

Q168: Short-term investments are securities that are _

Q172: Under the cost method dividends received from

Q173: An unrealized gain or loss on available-for-sale

Q174: Debt investments are investments in government and

Q176: A company that owns more than 50%

Q184: At the end of an accounting period,

Q186: PWAT Inc. had these transactions pertaining to

Q187: King George Company has these data

Q189: Ultra Cosmetics acquired 10% of the 200,000

Q193: When a company invests for speculative purposes,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents