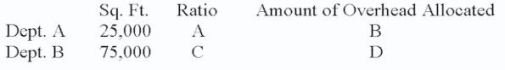

Complete (assume $100,000 of overhead to be distributed):

A. .25

B. $25,000

C. .75

D. $75,000

Correct Answer:

Verified

Q41: Jones Co. uses the retail inventory method.

Q46: Calculate using retail method: Q47: Calculate inventory turnover at cost (to nearest Q47: Crestwood Paint Supply had a beginning inventory Q51: Johnson Co. uses the retail inventory method. Q52: Calculate inventory turnover at cost (to nearest Q53: Allison Co. has a beginning inventory costing Q56: Bauer Supply had total cost of goods Q75: Bob's Clothing Shop's inventory at cost was Q80: Molls Co. allocates overhead expenses to all

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents