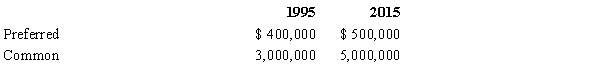

Dustin owns all of the stock of Gold Corporation which includes both common and preferred shares. The preferred stock is noncumulative, has no redemption date, and possesses no liquidation preference. In 1995, Dustin makes a gift to his adult children of all of the common stock. He dies in 2015 still owning the preferred stock. The value of the Gold stock on the relevant dates is:  One of the tax consequences of this estate freeze is:

One of the tax consequences of this estate freeze is:

A) Dustin's gross estate includes $0 as to the stock.

B) Dustin's gross estate includes $5,000,000 as to the stock.

C) Dustin made a gift of $400,000 in 1995.

D) Dustin made a gift of $3,400,000 in 1995.

E) None of the above is correct.

Correct Answer:

Verified

Q46: A decedent owned 25% of the voting

Q48: Which of the following independent statements correctly

Q61: Paul dies and leaves his traditional IRA

Q64: With respect to a stock interest in

Q67: In a typical "estate freeze" involving stock:

A)The

Q77: In 2015, Donna's father dies and leaves

Q82: In April 2014, Tim makes a gift

Q84: Lisa has been widowed three times. Her

Q85: For purposes of § 6166 (i.e., extension

Q97: Which, if any, of the following items

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents