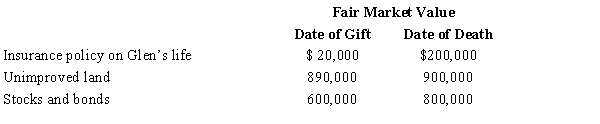

In 2013, Glen transferred several assets by gift to different persons. Glen dies in 2015. Information regarding the properties given is summarized below.

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000. As to these transactions, Glen's gross estate must include:

A) $0.

B) $200,000.

C) $260,000.

D) $1,900,000.

E) $1,960,000.

Correct Answer:

Verified

Q81: At the time of his death on

Q87: Match each statement with the correct choice.

Q100: At the time of her death, Megan

Q104: At the time of his death,Norton was

Q107: June made taxable gifts as follows: $200,000

Q111: Homer and Laura are husband and wife.At

Q114: Matt and Patricia are husband and wife

Q120: Mark dies on March 6,2015.Which,if any,of the

Q121: Prior to his death in 2015, Ethan

Q127: Ben and Lynn are married and have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents