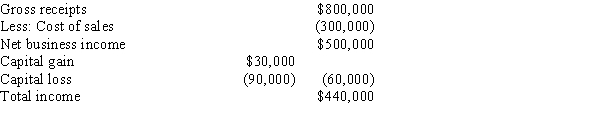

Jake, an individual calendar year taxpayer, incurred the following transactions.  Assuming that any error in timely reporting these amounts was inadvertent, how much omission from gross income would be required before the six-year statute of limitations would apply?

Assuming that any error in timely reporting these amounts was inadvertent, how much omission from gross income would be required before the six-year statute of limitations would apply?

A) More than $110,000.

B) More than $132,500.

C) More than $207,500.

D) The six-year rule does not apply here.

Correct Answer:

Verified

Q51: Which of the following statements correctly reflects

Q53: In preparing a tax return, a CPA

Q65: Lisa,a calendar year taxpayer subject to a

Q66: Juarez (a calendar year taxpayer) donates a

Q67: Michelle,a calendar year taxpayer subject to a

Q69: A registered tax return preparer who is

Q78: Gadsden, who is subject to a 40%

Q89: Which of the following is subject to

Q90: A tax preparer is in violation of

Q94: The usual three-year statute of limitations on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents