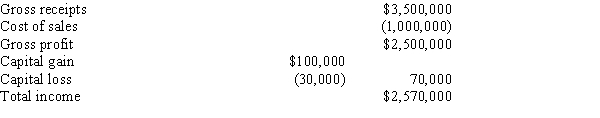

Loren Ltd., a calendar year taxpayer, had the following transactions, all of which were properly reported on a timely filed return. Presuming the absence of fraud, how much of an omission from gross income must occur for Loren before the six-year statute of limitations applies? Show your computations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q132: Match each of the following tax penalties

Q133: Match each of the following tax penalties

Q135: Match each of the following tax penalties

Q138: Match each of the following tax penalties

Q160: What are the chief responsibilities of the

Q161: Some taxpayers must make quarterly estimated payments

Q166: Evaluate this statement: a taxpayer is liable

Q168: Describe the potential outcomes to a party

Q170: Carole, a CPA, feels that she cannot

Q174: Minnie, your tax client, has decided to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents