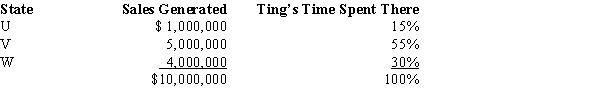

Ting, a regional sales manager, works from her office in State W. Her region includes several states, as indicated in the sales report below. Determine how much of Ting's $300,000 compensation is assigned to the payroll factor of State W.

A) $0.

B) $90,000.

C) $120,000.

D) $300,000.

Correct Answer:

Verified

Q45: In determining state taxable income, all of

Q47: In determining a corporation's taxable income for

Q48: A city might assess a recording tax

Q53: Which of the following is not immune

Q58: Under P.L. 86-272, which of the following

Q64: José Corporation realized $900,000 taxable income from

Q65: Britta Corporation's entire operations are located in

Q65: Trayne Corporation's sales office and manufacturing plant

Q66: Net Corporation's sales office and manufacturing plant

Q78: The throwback rule requires that:

A)Sales of tangible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents