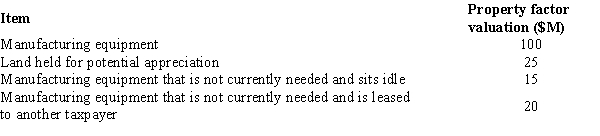

Hopper Corporation's property holdings in State E are as follows.  Compute the numerator of Hopper's E property factor.

Compute the numerator of Hopper's E property factor.

A) $100 million.

B) $135 million.

C) $140 million.

D) $160 million.

Correct Answer:

Verified

Q79: A state sales tax usually falls upon:

A)Sales

Q82: When the taxpayer has exposure to a

Q87: A state sales tax usually falls upon:

A)

Q94: Hendricks Corporation sells widgets in two states.

Q115: Parent Corporation owns all of the stock

Q119: In conducting multistate tax planning, the taxpayer

Q123: Match each of the following terms with

Q126: Match each of the following terms with

Q132: Match each of the following terms with

Q148: Match each of the following terms with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents