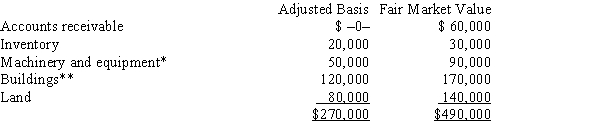

Mr. and Ms. Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Q44: Match the following statements.

-Sale of the individual

Q61: Fred and Ella are going to establish

Q67: Alice contributes equipment (fair market value of

Q69: Kristine owns all of the stock of

Q69: Malcomb and Sandra (shareholders) each loan Crow

Q70: Albert's sole proprietorship owns the following assets:

Q72: Bev and Cabel each have 50% ownership

Q73: Khalid contributes land (fair market value of

Q77: Bev and Cabel each own one-half of

Q171: Match each of the following statements with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents