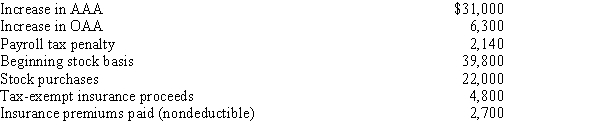

You are given the following facts about a solely owned S corporation. What is the shareholder's ending stock basis?

A) $61,800

B) $68,100

C) $99,100

D) $100,100

E) Some other amount

Correct Answer:

Verified

Q69: Which, if any, of the following items

Q83: You are given the following facts about

Q85: Samantha owned 1,000 shares in Evita,Inc. ,an

Q86: Randall owns 800 shares in Fabrication, Inc.,

Q87: During 2015,Miles Nutt,the sole shareholder of a

Q89: You are given the following facts about

Q90: Fred is the sole shareholder of an

Q94: On January 2,2014,Tim loans his S corporation

Q97: An S corporation reports a recognized built-in

Q100: A calendar year C corporation reports a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents