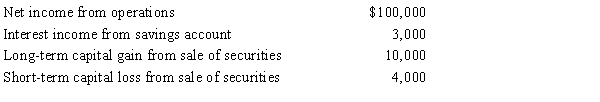

During 2015, Oxen Corporation incurs the following transactions.

Oxen maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder, Megan. As a result, Megan must recognize:

A) Ordinary income of $103,000.

B) Ordinary income of $103,000 and long-term capital gain of $5,000.

C) Ordinary income of $103,000, long-term capital gain of $10,000, and $4,000 short-term capital loss.

D) Ordinary income of $109,000.

Correct Answer:

Verified

Q69: Which, if any, of the following items

Q85: Samantha owned 1,000 shares in Evita,Inc. ,an

Q89: Which transaction affects the Other Adjustments Account

Q90: Fred is the sole shareholder of an

Q93: If an S corporation's beginning balance in

Q95: On January 2,2014,David loans his S corporation

Q98: On January 1,2015,Kinney,Inc. ,an electing S corporation,holds

Q98: Which of the following reduces a shareholder's

Q99: Which,if any,of the following items has no

Q99: Beginning in 2015, the AAA of Amit,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents