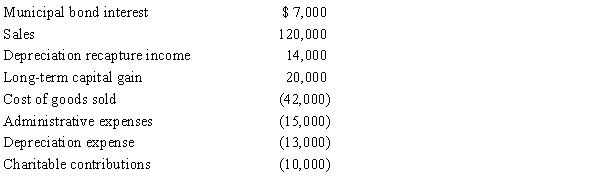

Estela, Inc., a calendar year S corporation, incurred the following items in 2015.

Calculate Estela's nonseparately computed income.

Correct Answer:

Verified

Q113: Discuss two ways that an S election

Q123: Towne, Inc., a calendar year S corporation,

Q124: Alomar, a cash basis S corporation in

Q126: Distribution of loss property by an S

Q129: You are a 60% owner of an

Q130: Gene Grams is a 45% owner of

Q132: Depletion in excess of basis in property

Q133: Bidden, Inc., a calendar year S corporation,

Q136: If an S corporation shareholder's basis in

Q138: With respect to passive losses,there are three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents