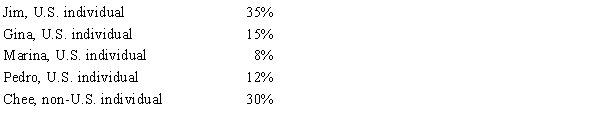

The following persons own Schlecht Corporation, a foreign corporation.

None of the shareholders are related. Subpart F income for the tax year is $300,000. No distributions are made. Which of the following statements is correct?

A) Schlecht is not a CFC.

B) Chee includes $90,000 in gross income.

C) Marina is not a U.S. shareholder for purposes of determining whether Schlecht is a CFC.

D) Marina includes $24,000 in gross income.

Correct Answer:

Verified

Q21: U.S. income tax treaties typically:

A) Provide for

Q42: Dividends received from a domestic corporation are

Q47: In which of the following independent situations

Q52: SilverCo, a U.S. corporation, incorporates its foreign

Q56: Generally, accrued foreign income taxes are translated

Q57: GoldCo, a U.S. corporation, incorporates its foreign

Q58: USCo,a U.S.corporation,purchases inventory from distributors within the

Q67: Kilps,a U.S.corporation,receives a $200,000 dividend from a

Q68: Chipper,Inc.,a U.S.corporation,reports worldwide taxable income of $1

Q71: Columbia,Inc.,a U.S.corporation,receives a $150,000 cash dividend from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents