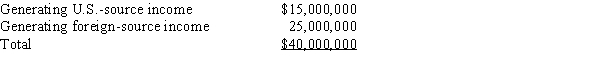

Goolsbee, Inc., a U.S. corporation, generates U.S.-source and foreign-source gross income. Goolsbee's assets (tax book value) are as follows.

Goolsbee incurs interest expense of $200,000. Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Yvonne is a citizen of France and

Q77: Which of the following is a principle

Q84: ForCo, a foreign corporation, receives interest income

Q89: Which of the following determinations requires knowing

Q91: Which of the following foreign taxes paid

Q95: Match the definition with the correct term.

-U.S.

Q100: GlobalCo, a foreign corporation not engaged in

Q123: With respect to income generated by non-U.S.

Q129: USCo,a U.S.corporation,reports worldwide taxable income of $1,500,000,including

Q143: Your client holds foreign tax credit (FTC)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents