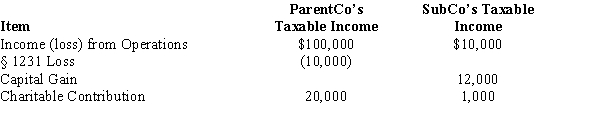

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $91,000

B) $100,800

C) $112,000

D) $122,000

Correct Answer:

Verified

Q83: All members of an affiliated group have

Q86: Deferring recognition of an intercompany gain is

Q88: When negative adjustments are made to the

Q90: Members of a parent-subsidiary controlled group must

Q91: The rules can limit the net operating

Q92: In terms of the consolidated return rules,

Q97: Most of the rules governing the use

Q99: Within a Federal consolidated income tax group,

Q99: ParentCo and SubCo recorded the following items

Q105: In the year that the group terminates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents