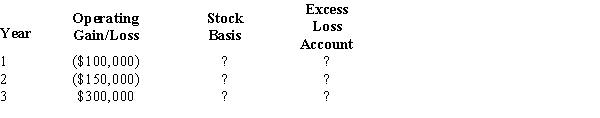

Calendar year Parent Corporation acquired all of the stock of SubCo on January 1, Year 1, for $500,000. The subsidiary's operating gains and losses are shown below. In addition, a $50,000 dividend is paid early in Year 2.

Complete the following chart, indicating the appropriate stock basis and excess loss account amounts.

Correct Answer:

Verified

Q103: Match each of the following terms with

Q108: Match each of the following terms with

Q113: ParentCo's controlled group includes the following members.

Q115: Parent Corporation's current-year taxable income included $100,000

Q117: Match each of the following terms with

Q133: Outline the major advantages and disadvantages of

Q139: Consider AB, a brother-sister group of U.S.

Q143: Describe the general computational method used by

Q144: Gold and Bronze elect to form a

Q148: ParentCo owns all of the stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents