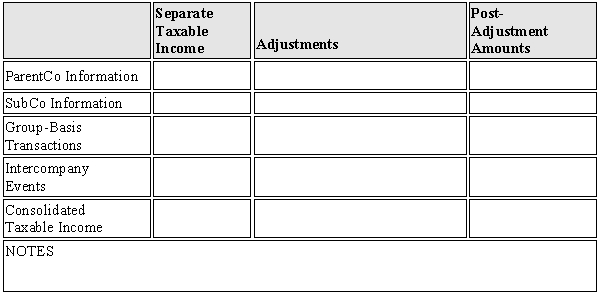

Parent Corporation's current-year taxable income included $100,000 net profit from operations and a $30,000 net long-term capital gain. Parent also made a $22,000 contribution to State University. SubCo produced $85,000 of income from operations and incurred a $25,000 net short-term capital loss.

Use the computational worksheet of Exhibit 8.3 to derive the group members' separate taxable incomes and the group's consolidated taxable income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Match each of the following terms with

Q108: Match each of the following terms with

Q110: Match each of the following terms with

Q111: Calendar year Parent Corporation acquired all of

Q113: ParentCo's controlled group includes the following members.

Q119: The U.S. states apply different rules in

Q133: Outline the major advantages and disadvantages of

Q134: List some of the nontax reasons that

Q144: Gold and Bronze elect to form a

Q150: Match each of the following terms with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents