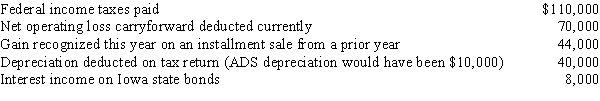

Rose Corporation (a calendar year taxpayer) has taxable income of $300,000, and its financial records reflect the following for the year.

Rose Corporation's current E & P is:

A) $254,000.

B) $214,000.

C) $194,000.

D) $104,000.

E) None of the above.

Correct Answer:

Verified

Q24: In a property distribution, the amount of

Q45: The tax treatment of corporate distributions at

Q46: Tungsten Corporation,a calendar year cash basis taxpayer,made

Q48: Silver Corporation, a calendar year taxpayer, has

Q62: As of January 1, Cassowary Corporation has

Q65: Falcon Corporation ended its first year of

Q68: Maria and Christopher each own 50% of

Q70: Which of the following statements is incorrect

Q76: Pheasant Corporation, a calendar year taxpayer, has

Q79: Stacey and Andrew each own one-half of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents