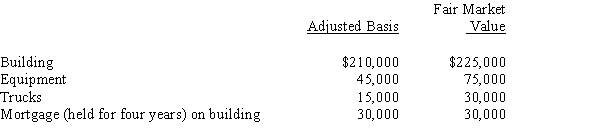

Rick transferred the following assets and liabilities to Warbler Corporation.

In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

A) Rick has a recognized gain of $60,000.

B) Rick has a recognized gain of $75,000.

C) Rick's basis in the stock of Warbler Corporation is $270,000.

D) Warbler Corporation has the same basis in the assets received as Rick does in the stock.

E) None of the above.

Correct Answer:

Verified

Q21: Basis of appreciated property transferred minus boot

Q22: When depreciable property is transferred to a

Q24: A shareholder transfers a capital asset to

Q40: A shareholder's holding period for stock received

Q42: If a shareholder owns stock received as

Q43: Mitchell and Powell form Green Corporation. Mitchell

Q46: Eileen transfers property worth $200,000 (basis of

Q50: Gabriella and Juanita form Luster Corporation. Gabriella

Q56: Amy owns 20% of the stock of

Q75: Albert transfers land (basis of $140,000 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents