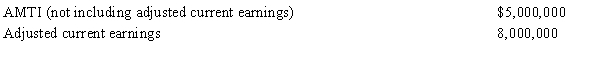

During 2015, Red Corporation (a calendar year taxpayer) has $4,000,000 of taxable income and the following transactions:

Red Corporation's alternative minimum tax (AMT) for 2015 is:

A) $1,360,000.

B) $700,000.

C) $500,000.

D) $90,000.

E) None of the above.

Correct Answer:

Verified

Q66: Which of the following is added in

Q67: Which of the following items will have

Q68: Jackson, Inc., has the following items related

Q68: Which of the following items will be

Q70: Which of the following items will be

Q70: A small corporation with unused minimum tax

Q71: Ford Corporation, a calendar year corporation, has

Q72: Which AMT adjustment would only be negative?

A)Passive

Q77: Which statement is false?

A)The starting point for

Q78: In 2015, Job Corporation, a calendar year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents