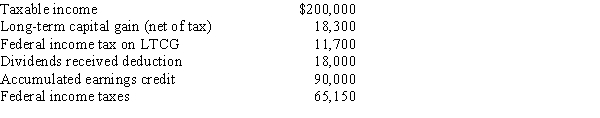

Rohan, Inc., a calendar year closely held corporation, is not a PHC. If the company reports the following items, the accumulated taxable income is:

A) $44,550.

B) $62,850.

C) $80,850.

D) $109,700.

E) None of the above.

Correct Answer:

Verified

Q88: Swan Corporation has gross receipts of $3

Q90: Rose Corporation, a calendar year corporation,

Q91: Which of the following items will be

Q92: Tanver Corporation, a calendar year corporation, has

Q94: Sweet Corporation, a new corporation, has gross

Q95: Which statement is false?

A)The AMT is not

Q95: Ace Corporation incurred the following taxes for

Q96: Mayberry, Inc. engages in production activities that

Q101: What is undistributed PHCI?

Q105: How is DPAD handled in an S

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents