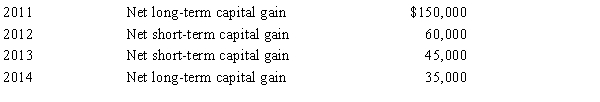

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2015. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2016.

Compute the amount of Carrot's capital loss carryover to 2016.

A) $0

B) $32,000

C) $45,000

D) $185,000

E) None of the above

Correct Answer:

Verified

Q26: Schedule M-3 is similar to Schedule M-1

Q32: A corporation with $5 million or more

Q35: Income that is included in net income

Q44: Rachel is the sole member of an

Q47: Flycatcher Corporation,a C corporation,has two equal individual

Q48: Copper Corporation,a C corporation,had gross receipts of

Q49: Which of the following statements is incorrect

Q52: On December 31,2015,Peregrine Corporation,an accrual method,calendar year

Q56: Saleh, an accountant, is the sole shareholder

Q58: Elk, a C corporation, has $370,000 operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents