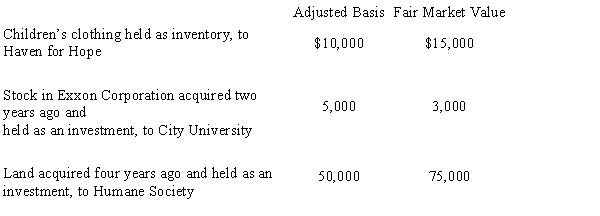

During the current year, Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation) ?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

Correct Answer:

Verified

Q26: Schedule M-3 is similar to Schedule M-1

Q41: Grebe Corporation, a closely held corporation that

Q42: During the current year, Woodchuck, Inc., a

Q47: In the current year, Plum Corporation, a

Q53: Bjorn owns a 60% interest in an

Q56: Ivory Corporation,a calendar year,accrual method C corporation,has

Q56: In the current year, Sunset Corporation (a

Q59: Norma formed Hyacinth Enterprises, a proprietorship, in

Q64: Nancy Smith is the sole shareholder and

Q67: During the current year, Kingbird Corporation (a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents